Similar to a will, a trust gives you the power to decide how your assets are handled. The main difference between a will and trust is that the latter is enacted while you're still living. Living trusts can be classified as either revocable or irrevocable. Deciding which trust is right for you can be difficult, but Anthoor Law Group can help. With a properly drafted trust, you can retain control of your assets and the handling of your estate if incapacity or death were to occur.

With a Living Trust , you can benefit from the following:

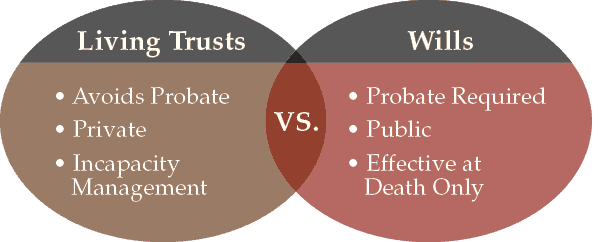

While a valid will provides directions on how your assets are handled, your estate may still be probated in the event of your death. When you create a living trust, on the other hand, any possessions held in the trust are not subjected to estate administration by the probate court after the grantor (the creator of the trust), dies. You can also gain substantial tax advantages, and protect details of any possessions in your trust from the public filing process required in probate.

Call (510) 794-2887 or fill out the short form below. We will usually respond within 1 business day but often do so the same day. Don’t hesitate, your questions are welcome.

We respect your privacy. The information you provide will be used to answer your questions or to schedule an appointment if requested.

Mon-Fri: 9am – 6:30pm

Anthoor Law Group, A Professional Corporation a law firm, is conveniently located in Fremont, California. We are committed to providing each of our clients with the highest quality of legal representation possible.

© Copyrights 2024. Anthoor Law Group, A Professional Corporation. All Rights Reserved.

Powered by Green Cardigan Marketing

The information you obtain at this site is not, nor is it intended to be, legal advice. You should consult an attorney for advice regarding your individual situation. Contacting us does not create an attorney-client relationship.